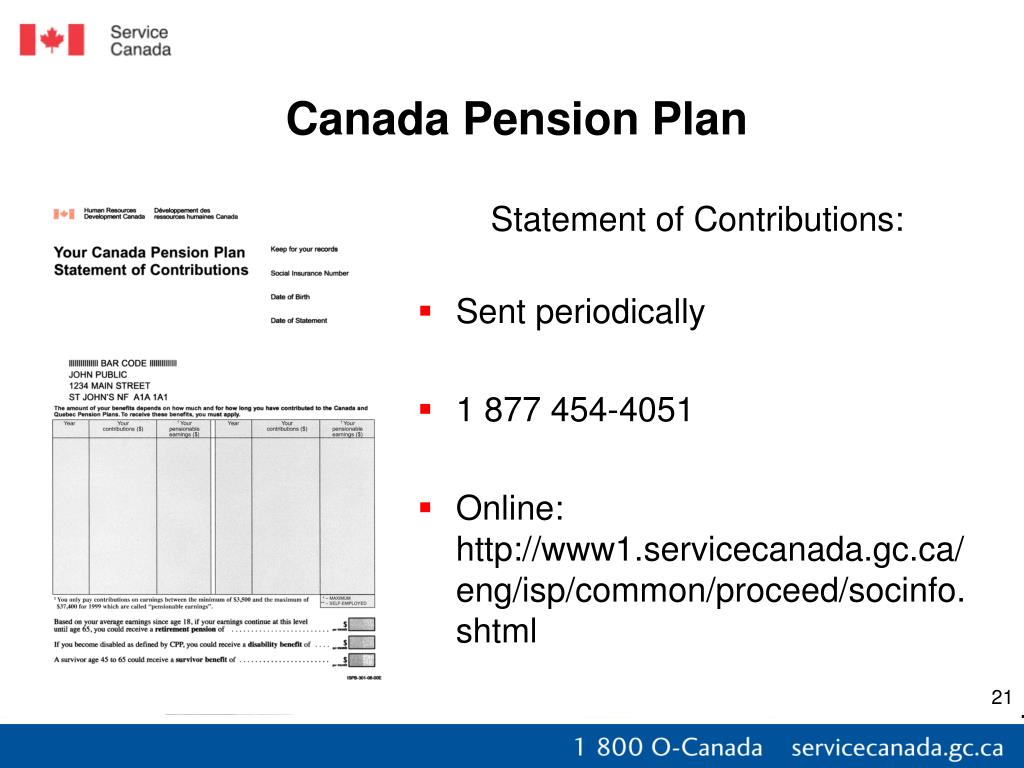

SC ISP-1300 (2011-11-15) E. 1 of 7 Service Canada. Protected when completed – B Personal Information Bank HRSDC PPU 146. Application for a Canada Pension Plan

View/change personal information while residing out of Canada. If you have or had an address or direct deposit outside Canada or are receiving Canada Pension Plan (CPP) or Old Age Security (OAS) benefits under an international agreement, you will only be able to view your information online.

The Old Age Security pension (or OAS or OAS-GIS) is a taxable monthly social security payment available to most Canadians 65 years of age or older with individual income less than $122,843.

Ed There is absolutely no connection between where you live and your eligibility for any of the CPP benefits. I think you’re getting confused between CPP and OAS (Old Age Security).

.png)

Service Canada. Application for a Canada Pension Plan Death Benefit. Service Canada delivers Human Resources and Skills Development Canada programs and services for the Government of Canada.

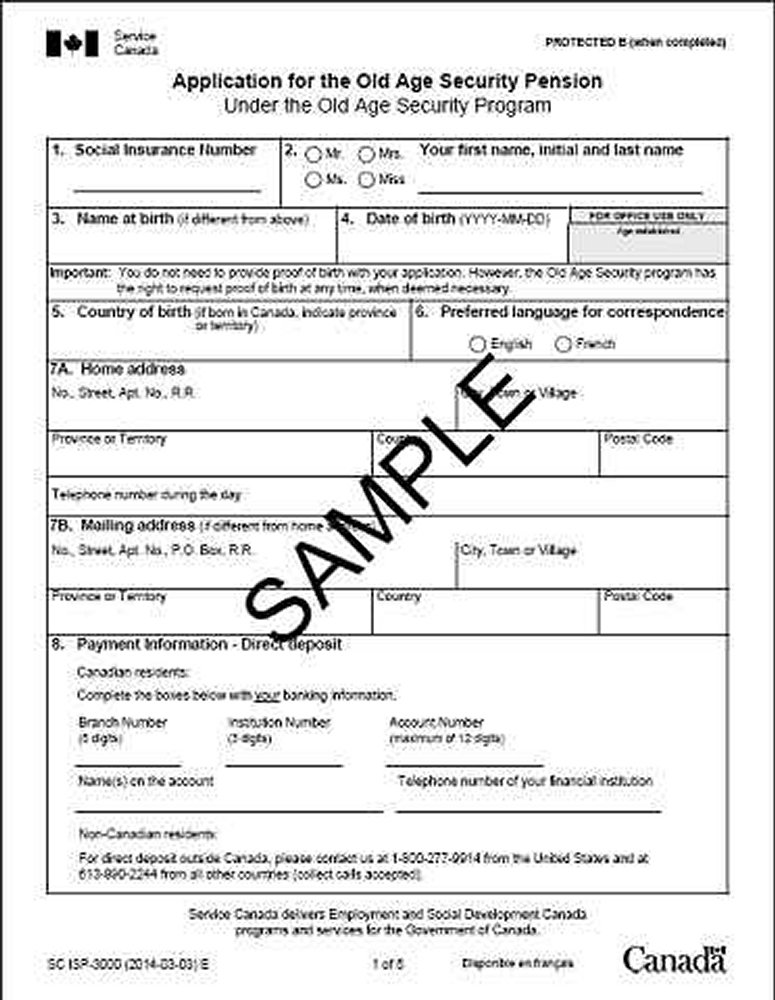

Old Age Security (OAS) Pension – Frequently Asked Questions • Important Information for Common-law Partners • About the Old Age Security pension • Applying for the Old Age Security pension

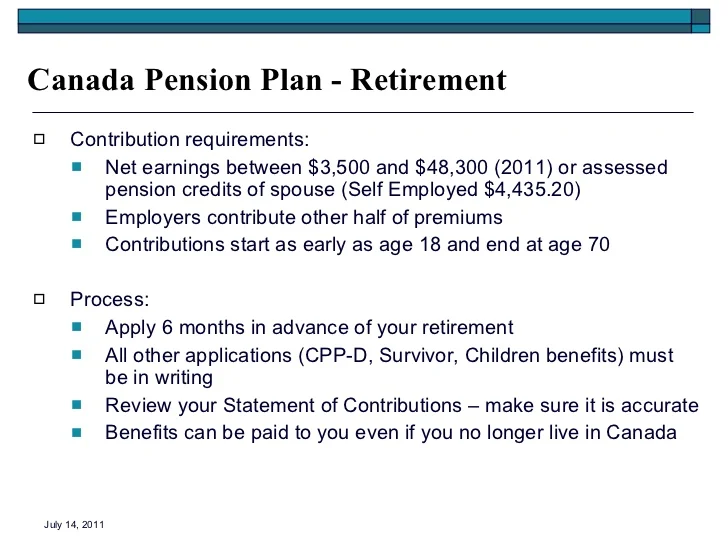

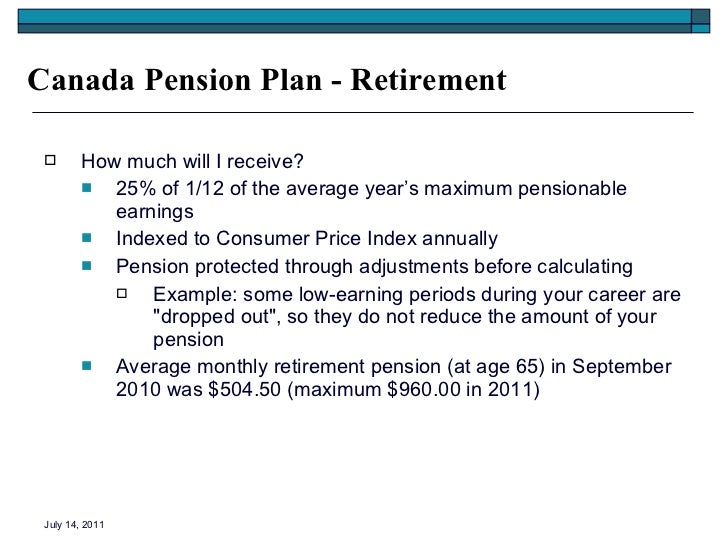

1. How much will I get from Canada Pension Plan? Less than you might think. The maximum CPP amount for 2010 is $934.17 per month starting at age 65.

Canada’s Old Age Security (OAS) pension is a monthly payment available to most Canadians 65 or older, regardless of work history. It’s not a program that Canadians pay into directly, but rather funded out of the Canadian Government’s general revenues. Service Canada automatically enrolls all

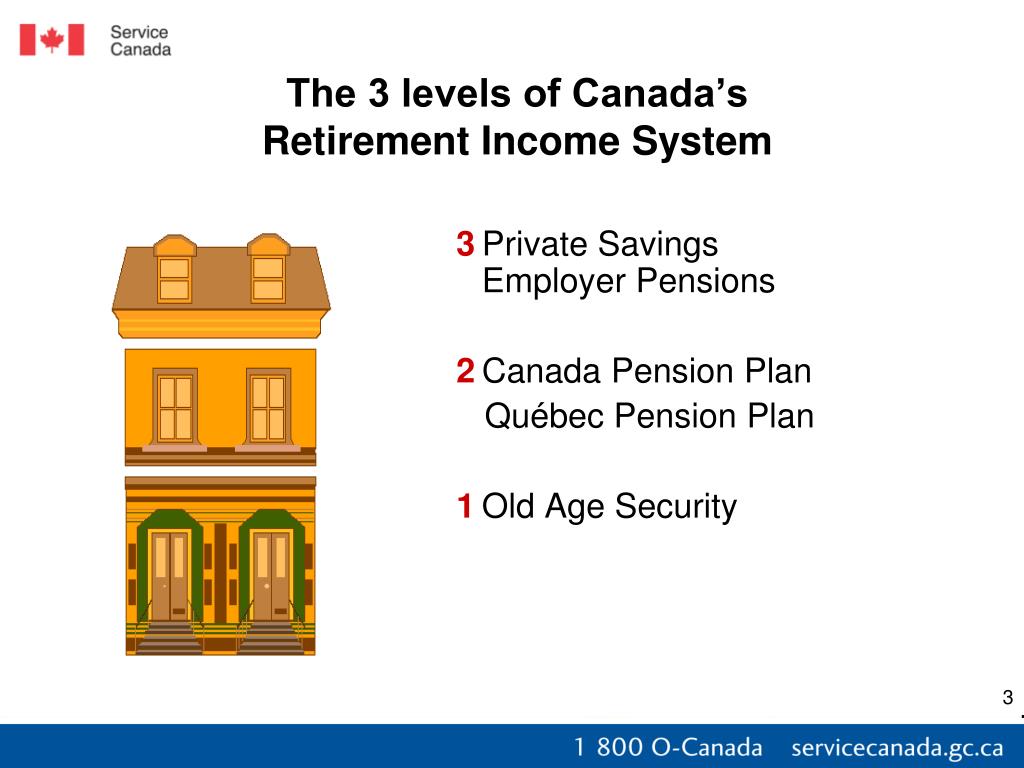

The Old Age Security (OAS) pension is one of the three main pillars of Canada’s retirement income system. The two other pillars are the Canada Pension Plan (CPP) and Employment Pension Plans/Individual Retirement Savings.

The payment amount for the Old Age Security pension is determined by how long you have lived in Canada after the age of 18. It is considered taxable income and is subject to a recovery tax if your individual net annual income is higher than the net world income threshold set for the year. Payment